Why Recovering from Losses Takes More Than You Think

Financial Navigator Post

11/08/2025

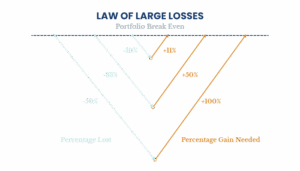

Market downturns can be unsettling, but they are a natural part of the investment cycle. What many investors overlook is how much more it takes to recover from a loss than it took to incur it.

If your portfolio drops 20 percent, you need more than a 20 percent gain just to break even.

This is the Law or Large Losses:

- A 20 % loss requires a 25 % gain to break even

- A 33 % loss requires a 50 % gain to break even

- A 50 % loss requires a 100 % gain to break even

The larger the loss, the harder it is to climb back. This is why having a robust portfolio that protects capital becomes increasingly important as you approach retirement or begin drawing income from your portfolio. If you are forced to sell after a downturn, you risk locking in permanent losses and breaking the compounding engine that drives long-term growth.

However, volatility also creates opportunity. The same maths that makes recovering from losses difficult also means new capital deployed during downturns can benefit powerfully from the rebound. A 50 percent market decline followed by full recovery represents the possibility of 100 percent return.

History shows that markets have recovered from every major decline given time and discipline.

What matters most is having a portfolio that fits your stage of life, your income needs, and your ability to stay invested. Market drops will come. The key is to be well positioned to survive them when nearing retirement and to be able to benefit from the recovery opportunities when time is still on your side. By keeping these principles in mind, you can better navigate market volatility and protect your portfolio’s growth potential.

Get in Touch

Want to safeguard your investments and stay committed through market swings? Speak with the team at Oreana Private Wealth. We will help you build a disciplined strategy designed to preserve growth and confidence.