2023 Year-end Review

Market Insight

03/01/2024

Economic review

This year has seen volatility across asset classes as investors struggle to digest a slowing economy, stubbornly high inflation, a robust labour market, and deteriorating financial sector health. Geopolitics have also been at the forefront of news cycles, with government shutdowns in the US over the debt ceiling, US-China tensions, and war in the Middle East and Europe.

Inflation has trended lower over the year, as a result of the most aggressive rate hike cycle seen for several decades. US CPI inflation has fallen from 6.5% to a low of 3.0% in June, ticking up higher in Q3 due to oil prices and then falling back to 3.2% by October. That is still above Fed target, but is significantly lower than the peak of 9.1% in mid-2022. Most central banks have now reached the end of their rate hike cycles. Australian inflation also trended lower, but at a slower rate. The Reserve Bank of Australia were more cautious in their monetary policy, and opted for a more wait-and-see, data-driven stance.

Labour markets in Australia and the US have remained somewhat resilient, with unemployment rates hovering around record lows, but that resilience has shown some weakness in the second half of the year. In Australia, unemployment fluctuated around 3.7% over the year, well below pre-pandemic levels. But the ANZ job ads data have been deteriorating – and that tends to lead the unemployment rate higher. In the US, unemployment and jobless claims have been trending higher for several months.

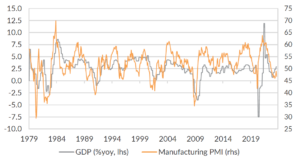

Manufacturing PMI in the US had trended towards recessionary levels before bouncing back up in September. It has since corrected from that rebound and trended lower. The US manufacturing sector is a key indicator for economic growth, and has been signaling consistently below-trend growth since Q4 2022. The data sits near 46 right now. A number below 45 has always indicated recession. Earnings growth has also followed lower over the year.

In stark contrast to the rest of the world, China has been grappling with deflation this year in an economy that has struggled to gather pace. Although retail sales have started to improve over the second half of the year, both the manufacturing and services sectors have remained weak compared to history. Stimulus has been drip-fed into the market which has largely underwhelmed the economy and investors. Real estate investment fell by 9.3% in the first 10 months of the year compared with the same period last year, indicating the property market continues to be a drag on the economy.

While oil prices were considered one of the key drivers of inflation coming out of the pandemic, oil demand this year has appeared relatively subdued. Several OPEC+ countries have cut production – and agreed to significantly cut production further in the first quarter of 2024 – in order to prop up oil prices. Oil prices have been volatile throughout the year largely driven by geopolitical events, while underlying demand appears to have slowed substantially in line with a weakening global economy.

Market review

Global asset markets have been buffeted this year by the tension between higher central bank policy rates on one hand and economic resilience on the other. Key US economic data, particularly the labour market, indicated that parts of the economy were withstanding the cumulative impact from the higher Fed Funds rate.

Central bank rate hikes persisted through much of 2023. Elevated, albeit slowing, inflation allowed key central banks to credibly promise rates would move higher and remain higher for long. That pushed government bond yields higher through most of the year. In the US, the 2-year Treasury yield peaked around 5.25% and the 10-year Treasury yield briefly increased above 5.00%. At their peak, US Treasury yields were around 1.00% higher than at the end of 2023. Australian Government bond yields also briefly increased above 5.00%, also representing around a 1.00% increase. Government bond yields were incredibly volatile through the year, with unusually large daily, weekly and monthly moves in yields. By end-November, markets had moved to price in a higher likelihood of rate cuts through 2024, helping yields across the curve to move significantly lower.

Corporate credit spreads have narrowed through the year despite funding costs and rating downgrades and defaults increasing. High yield credit has performed remarkably well through a year that has been challenging for broader fixed income markets. US corporate credit spreads have been protected somewhat by a relatively low refinancing need across the markets and from generous yield on offer that has attracted investors.

Resilient economic outcomes helped US equities climb through the first half of the year. Slowing inflation spurred hopes that the Fed would be able to achieve a soft landing, further supporting US equities. By end-November, the US S&P500 was 19.0% higher, comfortably outperforming most other developed market equities. This equity market strength belied a correction through Q3 which saw the S&P500 fall around 10%. The decline reflected some slowing in earnings growth and the Fed’s “higher for longer” commitment. But equities surged through November as investors continued to hope for a soft landing from the Fed. The strength in equities was largely driven by the so-called “magnificent seven” – seven technology stocks that dominate the market capitalisation of the broader index and have surged as interest rates stabilised and then fell in November and December.

Japanese equities performed even better, with ultra-accommodative monetary policy settings helping performance. Australian equities have struggled however, with the ASX200 only 0.7% higher to end-November. Australia’s equities have been weighed by ongoing concerns around China’s economic outlook and ongoing property sector challenges. China’s equity market was 9.7% through end-November.

Diverging monetary policy outlooks have been the driver for some volatility across currency markets. The USD was largely unchanged versus the start of 2023 by end-November. But the global reserve currency weakened sharply in the first half of the year before rallying in Q3. The rally was driven by a growing view the Fed may have to deliver even more rate hikes in addition to safe-haven flows as investors suffered a brief growth scare. By October, markets had priced the Fed on hold allowing the USD to ease from its peaks. The Australian dollar remained weaker compared with the USD year-to-date at end-November. But some improvement in risk aversion and favourable interest rate differentials helped the AUD strengthen from troughs in October.

Three key charts to watch

Historically, when the Fed has finished tightening, the economic slowdown has given way to recession. But picking the timing of recessions is difficult. Here are three indicators you can use to monitor if and when the US will enter recession.

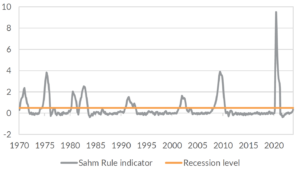

Chart 1: The Sahm rule accurately identifies recession.

Source: Bloomberg LP, Oreana.

Chart 2: The manufacturing PMI below the 45 level indicates a recession is imminent in the US.

Source: Bloomberg LP, Oreana.

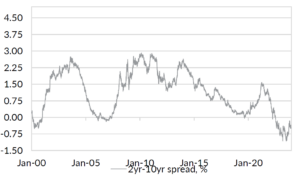

Chart 3: The yield curve is trending toward normalisation which is a signal for recession.

Source: Bloomberg LP, Oreana. 25

Key takeaway

The Fed is most likely finished hiking. Key metrics are highlighting the risk for recession in 2024. Timing a recession remains difficult, and for most investors accurately picking market turning points is a challenge. We prefer to be prepared – and have adjusted our portfolios to increase resilience over the medium-term. However, the most critical action for investors is to consider your portfolio, consider the outlook, and make sure you are comfortable with the level of risk you are taking given your expectations.