Equities continued to rally through the second quarter

Market Insight

11/07/2024

April was a challenging month in markets as economic data remained mixed and inflation appeared to accelerate in many developed economies causing tension in markets. But most of those fears quickly abated and markets rallied through May and June into the quarter-end.

Australian equities were challenged over the quarter in a marked economic slowdown, but with reaccelerating inflation. Consumer sentiment has collapsed as higher mortgage repayments weighed on consumer spending. The unemployment rate has trended higher to 4.0% from the low of 3.5%.

US Treasury yields did a round trip again this quarter. With accelerating inflation and a hawkish Fed driving yields higher in the first half, softening data allowed yields to fall back into the end of June.

Table 1: Asset class returns as of 30/6/2024

Source: Bloomberg, Morningstar

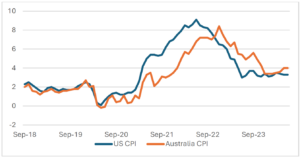

Inflation has trended lower in most developed markets.

Inflation in the US has trended lower over the quarter after seeming sticky in the first part of the year. Consumer prices were unchanged in May, bringing the annual rate down to its lowest level since 2021. Core PCE – the Fed’s preferred measure of inflation – was also unchanged in May. That has been a welcome surprise and led investors to reprice around two rate cuts from the Fed by the end of this year.

The Fed held rates steady through June as expected, while Fed Chair Powell recognized the progress on inflation and reinforced that monetary policy is restrictive. The Fed adjusted its year-end policy rate estimate higher to 5.1%, implying one 25bps rate cut is expected in 2024 instead of the three

cuts projected in March. Markets expect 2-3 rate cuts this year, but are uncertain on when they will begin. The European Central Bank and Bank of Canada began cutting rates in early June. Both banks expressed caution and indicated that further cuts will be data dependent.

Chart 2: Australian inflation has reaccelerated while trending in lower in most other developed markets

Source: Bloomberg

Australian inflation has reaccelerated, challenging the RBA.

In contrast, the Reserve Bank of Australia has been challenged by a reacceleration in inflation. Consumer prices surged from a low of 3.4% to 4.0% in May – the quickest rate in 5 months. That combined with indications of slowing consumer demand means the likelihood of a recession has increased. The Australian dollar weakened against the US dollar as expected interest rate differentials widened. While rate cuts were put back on the table to begin in September in the US, the RBA has been discussing further rate hikes to tame inflation. That pushed yields higher in Australia while US yields fell.

Market outlook

We think equity valuations are stretched and vulnerable to correction.

There is a disconnect between the “bad news is good news” narrative and the economic backdrop for that bad news. A material reacceleration in earnings growth would be required to justify current price/earnings. Economic data continue to point to growth slowing towards trend, which leaves companies vulnerable to any miss in earnings relative to expectations. In the near-term, momentum and sentiment around AI and tech could lead equities higher, further stretching valuations. While we think AI may provide productivity gains in the future, we do not think it can provide enough of a boost to productivity in the near-term to see that reacceleration in earnings growth.

We expect tensions between sticky inflation and deteriorating economic data to continue to drive volatility in bond markets.

We see a slowdown in economic activity in most developed markets, and as such if rates are kept elevated for too long there may be a policy error. We think the RBA may be forced to hike rates given the material acceleration in inflation in recent months. That poses a serious risk to the economy. We continue to think yields offer attractive return opportunities at current levels. If a recessionary or slowing growth environment emerges, government bond yields, particularly in the US and Australia, will prove to be critical downside protection for most diversified portfolios.

We think credit markets are not compensating investors adequately for the risk in the market.

Both investment grade and high yield spreads remain extremely tight, despite a trend higher in bankruptcies and credit downgrades. We think there is a growing tension between companies that want to hold off on issuance as policy rates are yet to be cut and absolute yields remain elevated, and companies that need to refinance debt and are taking the opportunity as spreads remain narrow.

Elevated geopolitical risk, a bumpy global economy and the start of interest rate cuts from developed market central banks is a challenging market for currency.

While yields are falling relative to other countries, the USD becomes less attractive. But in a downturn, the USD acts as a safe haven asset. Those opposing drivers could cause volatility. The risk of an RBA rate hike further adds pressure to the AUD, but also could be vulnerable to any negative surprises.

What does that mean for my portfolio?

It is time to rethink your equity allocations. High multiples have been pricing in a reacceleration in growth. But sales growth is falling and margins are shrinking. And what do companies do when they see margins falling? They cut costs through headcount. Rising unemployment could drive a doom loop on the economy. Even without that, valuations need to correct to reflect reality rather than hope.

It is time to improve resilience in portfolios. And that can be done by adding exposure to high quality, shorter duration fixed income. We have focused in on Treasuries but the back up in Australian government bond yields is also a place to consider. Within corporate credit, shorten spread duration and increase quality. Within equities, reducing overall market beta is important. That could be actioned by lowering equity market exposure or by increasing relative exposure to quality value. We’d also have a modest tilt towards global versus Australian equities relative to neutral settings