Five Risks for 2026

Market Insight

30/09/2025

Key messages:

• Economic data are mixed – pointing to some areas of resilience and some areas of weakness.

• Equity markets are at historically elevated valuations, as US Treasury yields have fallen.

• Risks exist both to the upside and downside as we approach 2026. Q4 is a sensible time to review portfolios and position for a range of potential outcomes.

Five risks for 2026

2025 has so far been a solid year for equity and fixed income returns. Despite a range of economic and policy uncertainties, investors have been willing to pay more for earnings in the US, resulting in a push higher in equity valuations. Policy rate expectations have moved lower in the US and Australia, helping bonds rally and credit spreads tighten. As we approach 2026, it makes sense to take stock of the risks for investors, both to the upside and the downside. In this note, highlight five key risks for 2026, and make some comments on the implications for investor portfolios.

Risk 1: Returns revert to historic averages.

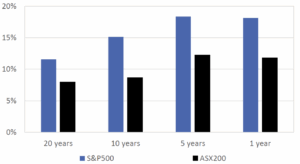

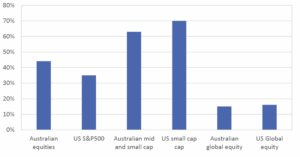

Equity markets have ripped higher in the past 5 years, with double digit average total returns becoming the norm. The average total return in the US has approached 20%. In Australia, it is close to 15%. These returns are unusual relative to history. Chart 1 shows something closer to 10% and 8% in the US and Australia respectively, over a 20-year period.

Chart 1: Average returns have been very strong over the past 5 years.

Source: Bloomberg LP, Ascalon.

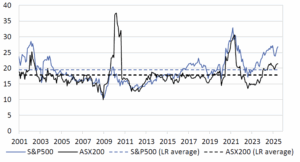

Valuations are now very stretched relative to history. Chart 2 shows a longer-run average, with both the US and

Australia equity market sitting well above these averages.

Chart 2: Stretched valuations relative to history have not been good for forward looking returns.

Source: Bloomberg LP, Ascalon.

Stretched valuations have historically coincided with weak forward-looking returns. It is important to note this does not mean negative returns. But we characterize these markets as having potentially had returns dragged from the future.

For investors, there are two key implications. First, investors may need to prepare for lower returns than they have experienced over the past five years. This could feel bad, even though the absolute return could be ok.

And second, it makes sense to carefully consider allocations to equities, especially if allocations have built up over the ripping bull market of the past five years.

Risk 2: Australia outperforms the US.

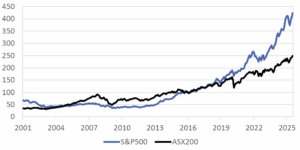

Australian equities have been a material underperformer relative to US equities over the past decade. Many of the reasons are well documented – the rise of technology and more recently, AI, US economic exceptionalism, structural slowdown in China weighing on Australia, among others.

Chart 3: US equities have delivered strong returns to investors over the past 10 years.

Source: Bloomberg LP, Ascalon.

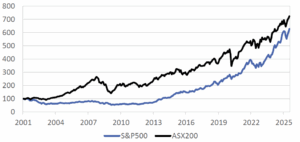

But this US outperformance has not always been a feature of global markets. The first part of this century saw Australia ride a mining construction boom to material outperformance. Australia truly was a lucky country, avoiding recession and experiencing significant financial inflows into its domestic markets.

Chart 4: A wider lens shows Australian equities have been a strong performer this century.

Source: Bloomberg LP, Ascalon.

Right now, US exceptionalism remains a consensus market narrative. But Australia is not without its advantages. And economic and political uncertainty in the US remains a downside risk to ongoing US equity market performance.

We are cautious on the outlook for both US and Australian equities, given the elevated valuations described in Risk 1. However, given the relatively less stretched overvaluation in Australia, there is scope for Australian equities to deliver benefits within a diversified portfolio.

Risk 3: Active managers outperform passive indexes.

Active managers have had a challenging time beating benchmarks over the past several years. There are several conditions that have made it difficult to outperform. Key among these is the extreme market concentration driven by US mega cap stocks. As these companies have grown as a share of the index, active managers have struggled to match returns from the very strong index rally in 2024 and early 2025.

Chart 5: % of managers that outperformed their benchmark in 2024.

Source: Bloomberg LP, Ascalon.

Some active managers have performed better more recently. As an asset class, small cap managers did a good job outperforming their benchmarks in 2024 – although absolute performance was less strong.

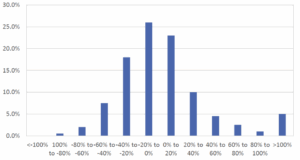

Chart 6: In 2024, 54% of ASX200 stocks underperformed the index.

Source: Bloomberg LP, Ascalon.

Chart 6 shows excess returns in the ASX200 were very narrowly distributed in 2024. More than half of the equities in the ASX200 underperformed the index. This started to change in 2025.

2026 is shaping up to be a potentially stronger year for stock pickers. Valuations are stretched, volatility is increasing, and rotations between sectors and factors have increased.

For investors, we think that while index allocations remain a valuable tool for portfolio construction, active managers may prove to be a valuable source of diversification and risk management over the medium-term.

Risk 4: AI fails to deliver.

The artificial intelligence narrative has been the key driver of equity market returns over the past three years. The expectation that AI will permeate the economy and drive material productivity enhancements, support margins and sales, has driven equity market valuations to historic high levels.

It seems clear that AI will be an important part of the global economic outlook. In the US, the contribution to GDP from investment in information processing equipment has matched the contribution from consumption. Without that capex investment, the US may very well have already slipped into recession.

But it is less clear yet that all of the promise delivered by AI will be met. There are a number of risks that can be identified to the prevailing narrative. For example:

- A slowdown in AI capex spending could occur.

- AI could fail to improve materially from its current state.

- There could be a failure of widespread user cases for AI in the broader economy.

- There could be an accounting scandal because AI companies are depreciating their capital expenditures over ten years – well in excess of the likely useful life – which can boost reported profits at AI companies.

For investors, exposure to the AI theme has been an important driver of returns. But that has resulted in material concentration risk and exposure to a single thematic. We think diversification remains critical within equity market sleeves, and, given the significant rally over recent years, it makes sense to build resilience within equity sleeves.

Risk 5: Interest rates fall below market expectations.

The rate cut in September was positioned by Fed Chair Powell as a risk management cut. But I expect the Fed is going to be cutting rates over the remainder of 2025 and into 2026. The market currently has 4 more cuts priced in, which seems broadly sensible.

The challenge for investors is that rates could be cut for different reasons. It could reflect a carefully implemented gradual reduction in rates from restrictive to neutral, allowing the US economy to stabilize without material inflationary pressures. On the other hand, the Fed may be forced to cut rapidly as the economy continues to slow, even as inflation remains sticky.

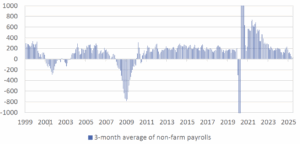

Chart 7: Rates could fall because markets are anticipating a slowing economy as job gains collapse.

Source: Bloomberg LP, Ascalon.

The implications for investors are very different. In the former, stable growth and contained inflation provides a more positive environment for risk assets. But in the latter, a slower economy and sticky prices could lead to deeper job cuts. This doesn’t need to mean recession, but given equity markets are pricing a reacceleration in growth, valuations may need to reprice much lower in this scenario.

What can investors do to manage risks?

The risks we have identified here are only some of many risks facing investors. There are some specific actions investors can take to mitigate or harness upside from these risks. But importantly, investors should use Q4 as an opportunity to review portfolios and assess any unintended exposures that may exist. We think it is a good time to increase diversification – that is, across geographical exposures, risk factors, index and passive investments as well as across asset classes. We expect resilience will be rewarded in 2026 and beyond, and that means avoiding the temptation to chase rallies or succumbing to FOMO. Most importantly is staying invested – the prospect for increased volatility means that timing the market will be even more challenging in the period ahead.

Disclaimer: This presentation has been prepared by Oreana Private Wealth, a division of Oreana Financial Services(Oreana) for general information purposes only, without taking into account any potential investors’ personal objectives, financial situation or needs. This information consists of forward-looking statements which are subject to known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements to be materially different from those expressed or implied. Past performance is not a reliable indicator of future performance. Neither this document nor any of its contents may be used for any purpose without the prior consent of Oreana. Anyone reading this report must obtain and rely upon their own independent advice and inquiries.

Limitation of liability: Whilst all care has been taken in preparation of this report, to the maximum extent permitted by law, Oreana will not be liable in any way for any loss or damage suffered by you through use or reliance on this information. Oreana’s liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Oreana’s option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you.