How to manage risk when this time isn’t different

Market Insight

28/11/2023

The US Federal Reserve has now hiked rates to a level that is clearly restrictive for the economy. That tends not to end well. And yet there is still a view that the US can achieve a soft landing in 2024. It is possible. It just doesn’t seem probable. In this note, we share three good metrics to monitor the US economy. I think risks are skewed to the downside, and that means portfolios need to be positioned carefully to manage potential drawdowns.

Three good metrics to monitor.

Historically, when the Fed has finished tightening, the economic slowdown has given way to recession. But picking the timing of recessions is difficult. Here are three indicators you can use to monitor if and when the US will enter recession.

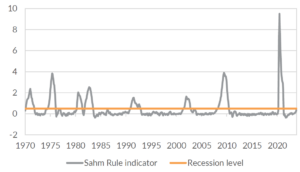

The Sahm Rule.

The Sahm Rule identifies the start of a recession when the three-month moving average of the US unemployment rate increases by 0.50% or more relative to its low during the previous 12 months. The indicator is currently at 0.33%. It is trending higher. The labour market is softening. The Sahm rule isn’t flashing red yet, but there is a real amber alert for investors.

Chart 1: Job openings are collapsing – and that tends to lead growth lower.

Source: Bloomberg LP, Oreana.

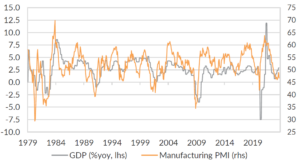

The manufacturing PMI.

The ISM manufacturing PMI has historically been a good leading indicator of recession. When the PMI falls below 50, it indicates the US economy is growing below trend. When the index falls below 45, then there has been a recession typically within six months. The PMI bounced higher from June this year but has retraced back to 46.7 in October. Similar to the Sahm rule, this isn’t at red alert yet. But it is trending in a worrying direction for investors.

Chart 2: The manufacturing PMI below the 45 level indicates a recession is imminent in the US.

Source: Bloomberg LP, Oreana.

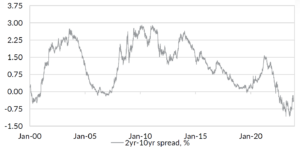

The yield curve.

An inverted yield curve happens when the 10-year Treasury yield falls below the 2-year Treasury yield. Historically, inversion has preceded recession by up to a couple of years. But a timelier indicator for recession is the normalisation of the yield curve. This happens when the 2-year Treasury yield falls back below the 10-year yield. Currently, the curve has been trending towards normalisation, albeit remaining inverted.

Chart 3: The yield curve is trending toward normalisation.

Source: Bloomberg LP, Oreana.

No recession yet, but risks skewed to the downside.

The trend in the three metrics is concerning. It suggests risks remain skewed to the downside for the economy after aggressive rate hikes from the Fed.

Other data suggest caution. The cumulative increase in prices since early 2020 has outstripped the cumulative increase in average hourly earnings by around 6%. Households will be feeling the pinch from higher prices and higher interest rates. Large retailers in the US are highlighting the risk that households retrench spending even as goods price inflation slows. The weekly initial jobless claims surged and jobs growth is cooling. The US is clearly not in recession yet, but historically the Fed has struggled to achieve a soft landing.

Manage risk as the Fed remains on pause.

Equity markets have tended to perform reasonably well when the Fed ends hiking and moves to a pause. Recent data have made it likely the Fed is done hiking. US equity markets have responded by rallying from the late-October trough.

I think this is not the time to be chasing risk. The post-hiking equity rally can continue up until the point when bad news simply becomes bad news. And the data trends suggest that could begin as soon as early-2024. We’ve been underweighting developed market equites through Q3. For investors that have weathered the pain through Q3, an equity rebound represents an opportunity to lighten up on exposure.

We suggest caution in credit markets too. I think high yield spreads are not adequately compensating investors for the risk of downgrades and defaults in a recession. We have shifted exposure to high quality investment grade credit, with a preference for short spreadduration.

For many investors, high quality government bonds will be a critical addition to a diversified multi-asset portfolio. Treasury yields are attractive in an outright sense. But it is the prospect for significant rate cuts that make this such an important asset class. We have been overweight short-dated government bonds. We have some longer-duration government bonds that became very attractive as yields exploded higher in October. This is a more volatile exposure but adds some additional downside protection, particularly in higher risk portfolios where equity beta dominates outcomes.

Time to focus on portfolio resilience.

The Fed is most likely finished hiking. Key metrics are highlighting the risk for recession in 2024. Timing a recession remains difficult, and for most investors accurately picking market turning points is a challenge. We prefer to be prepared – and have adjusted our portfolios to increase resilience over the medium-term. However, the most critical action for investors is to consider your portfolio, consider the outlook, and make sure you are comfortable with the level of risk you are taking given your expectations.