Making sense of the last month

Market Insight

02/09/2024

The US jobs report for July was ugly. Fewer jobs were added than expected, and the unemployment rate increased to a level that historically indicated recession in the US. Markets reacted swiftly to the worse than expected news. In this note, I explain what happened, why the market moved so sharply, where the economy may be headed, and what that might imply for portfolios.

What happened last week?

Late July and early August was a roller coaster for investors! A series of important data were released with the US jobs report being absolutely critical globally, and the Australian inflation numbers being critical in Australia. Alongside this, the Bank of Japan and the US Federal Reserve held its monetary policy meeting. Finally, earnings results were released for key mega-cap tech companies. The table below summarises the outcomes and immediate market reaction to the key data.

Table 1: Key events in late July.

Why did the market move so sharply?

The sharp movements were a combination of two disappointments relative to market expectations, and one material economic surprise.

Expectations matter for market movements. We have made the point recently that while the prevailing narrative was for a soft economic landing, the market pricing was really priced for a reacceleration of growth.

And the jobs report on Friday was certainly disappointing relative to market expectations for a

reacceleration of growth. The climb in the unemployment rate sparked fears that the US Fed is “behind the curve” and that a recession could eventuate in the near-term.

Similarly, the hype surrounding AI also helped push equities to valuation levels that looked stretched. Earnings expectations had been continually ratcheted higher. The equity market was vulnerable to any disappointment in earnings – and that is what was delivered last week.

Meanwhile, in Japan, the surprise rate hike resulted in a strengthening of the Japanese yen. There is no doubt the Bank of Japan hoped to prevent further weakness in the yen. Unfortunately, the move higher in the Japanese currency unwound currency carry trades where the low-cost yen had been used to fund higher risk positions in US tech stocks and cryptocurrency. A stronger yen also made foreign investors’ positions in Japanese equities less attractive. The unwinding of these trades has contributed to global risk-off sentiment.

Table 2: Key market movements, 01 August to 06 August.

Source: Bloomberg LP, Ascalon.

Where is the economy headed?

It is important not to panic after weak data. While July’s US jobs report certainly increases the risk of US recession, it does not confirm it. Instead, we have previously suggested three indicators to monitor the US economy’s progress. On balance, the indicators do suggest that growth is likely to slow further.

1) The manufacturing PMI. The US manufacturing PMI is a good indicator of US economic health. When the indicator is above 50, it suggests above trend growth. Between 50 and 45 suggests below trend growth. And a reading below 45 is recessionary. The PMI bumped briefly above 50 in Q1. But it reversed course in the most recent reading. This is a worrying development that growth could be slowing faster than anticipated.

Chart 1: Manufacturing PMI is at below-trend levels.

Source: Bloomberg LP, Ascalon.

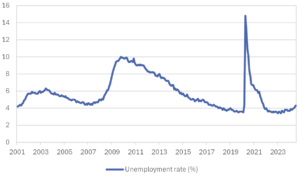

2) The change in the unemployment rate. The so-called Sahm rule is a measure of the rate of change of unemployment. A level above 0.5% has historically always correlated with recession. The measure improved in Q1, but on Friday the indicator breached the rule indicating recession. The robust labour market had been a key measure supporting hopes of a soft-landing – but rising unemployment will constrain the ability of households to keep spending.

Chart 2: The rate of increase in the unemployment rate is at recessionary levels.

Source: Bloomberg LP, Ascalon.

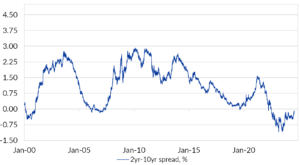

3) The yield curve. The US yield curve (the gap between the 2-year and the 10-year US Treasury yield) has been inverted for some time. Historically that has always preceded a US recession. But it has been the steepening of the yield curve from a negative number to positive that has highlighted a recession is imminent. Right now, the yield curve has steepened from lower than -1.00% to around -0.12%.

Chart 3: The US yield curve has steepened rapidly.

Source: Bloomberg LP, Ascalon.

What can SAA investors do now?

Market moves have been severe. But it is important not to panic. It is still unclear how rapidly the US economy may slow, how quickly the Fed could cut rates, and how oversold markets are after the recent turbulence.

When markets move like this, it is important to trust in the investment process. For investors with SAA models, it is important to remember that diversification will prevail in the long-run. Where an enhanced process is being used, our recommendations towards a modest overweight to higher quality credit and shorter duration Treasuries, funded out of equities, have helped moderate some of the impact from the recent volatility.

Right now, rate cuts are coming from the Fed. It is not clear whether they will come soon enough or deep enough to prevent growth from slowing further, and faster. Even so, we felt it was prudent to be cautious. We still believe that is the case. But we will continue to monitor market developments as volatility remains elevated.

Disclaimer:

NOTE: Oreana Private Wealth is only authorised to provide financial advice and services to Wholesale clients. The information we present is general and does not constitute personal financial advice. Do not rely on this information without obtaining specific advice relevant to your circumstances. Oreana Private Wealth performance does not indicate future performance, and all investments carry risk. Oreana Private Wealth does not guarantee the performance of any investment.

Anyone reading this report must obtain and rely upon their own independent advice and inquiries.

Limitation of liability: Whilst all care has been taken in preparation of this report, to the maximum extent permitted by law, Oreana will not be liable in any way for any loss or damage suffered by you through use or reliance on this information. Oreana’s liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Oreana’s option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you.