Prepare for market volatility as elevated valuations meet slowing growth

Market Insight

03/01/2025

We wrote last year how the market was priced for perfection. Markets expected slowing inflation, steady growth, and surgical rate cuts throughout the year. That largely played out, boosting equities and sentiment. The S&P 500 was up over 23% in 2024. In the first half of the year that was driven higher by the Magnificent Seven and hype around AI. In the second half of the year, returns broadened out. But that was largely driven by multiple expansion based on optimistic investor sentiment and expectations for central bank rate cuts. And markets have significantly repriced for fewer rate cuts this year.

Economic growth remains resilient, but not accelerating.

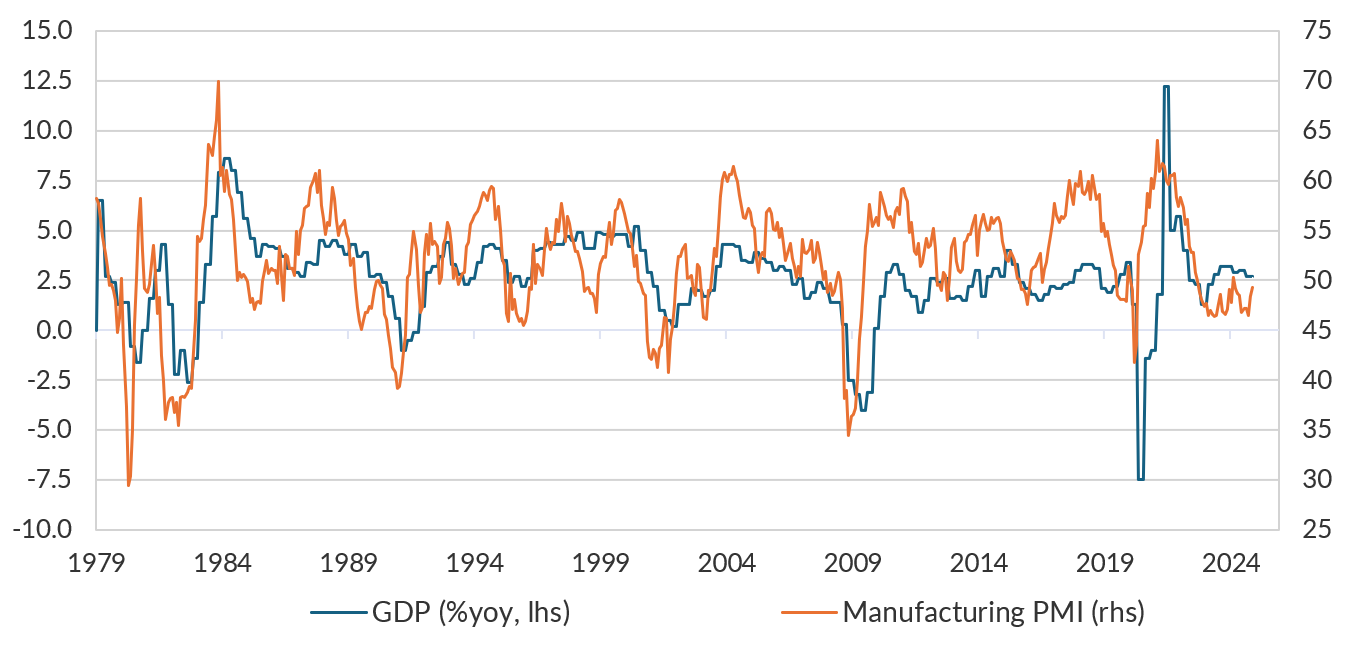

Economic growth was remarkably resilient in 2024, but it is not reaccelerating. The manufacturing PMI has been in contractionary territory for two years, bumping around between 46 and 50 – suggesting growth could slow further. In Australia, credit quality is deteriorating and households are feeling pain from higher mortgage rates. House price growth turned negative in December as buyers wait for rate cuts from the RBA. Labour markets are extremely tight in both the US and Australia. That has allowed consumers to continue spending despite higher policy rates. But as rates remain restrictive for a longer period of time, that will begin to weigh on consumers. And at historically tight levels, there is not much room for material improvement.

Equity valuations are stretched.

Equity markets are trading well above the long-run historic P/E in both the US and Australia. High valuations are not enough to drive a correction, but to justify those valuations, earnings must not only continue to grow, they must accelerate over 2025. And the outlook does not support that. The remarkably robust economy supported equities through 2024, but that strength means there is little scope for improvement and as such limits the room for reacceleration. Equity markets have already given up almost all the gains coming out of the US election and the focus is back on stock fundamentals.

Chart 1. Equity valuations are elevated compared to history (historic average shown by dashed lines).

Source: Bloomberg LP, Ascalon.

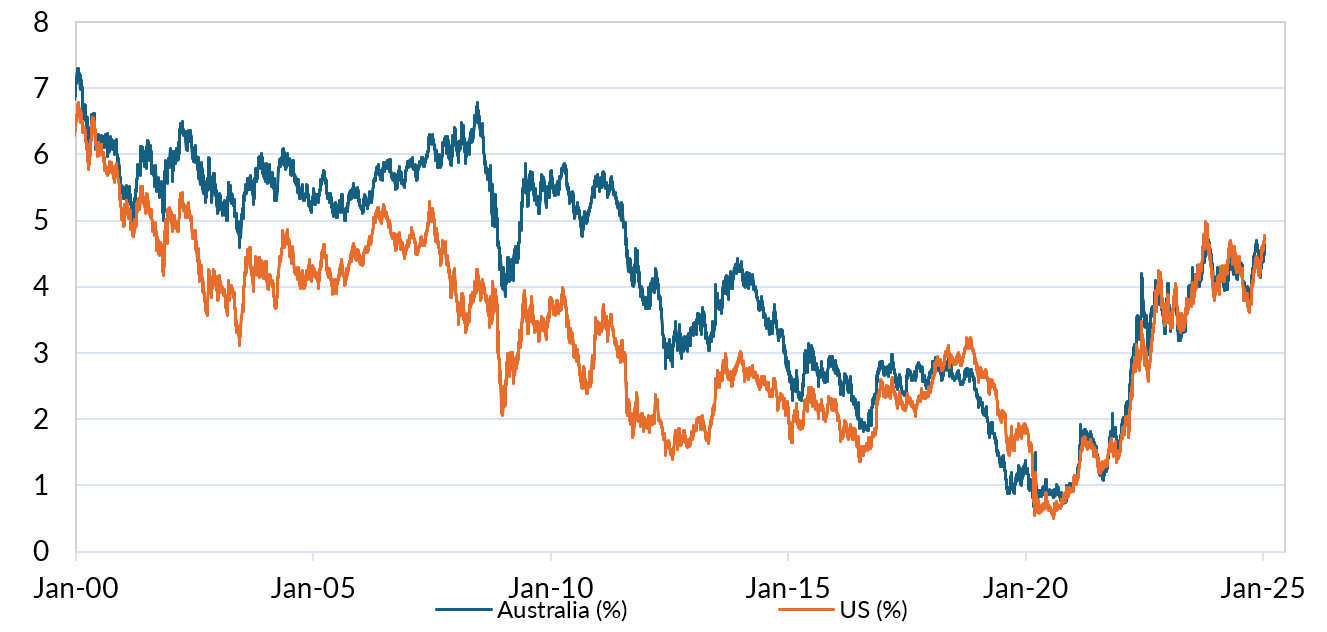

Government bond yields have soared in recent months.

Despite 100 basis points of cuts in 2024, the US 10-Year Treasury Yield has risen almost 100 basis points. That is unusual and will put a strain on equity returns. In Australia, both the short end and the long end of the yield curve were up over the year, largely driven by a mostly hawkish RBA and an unclear pathway for rates. The RBA turned more dovish into the end of the year, but a reacceleration in inflation and strong labour market has challenged that view. Higher yields weigh on equity valuations because that implies a higher discount rate for forward-looking valuations. Risks are to the upside in yields. Sticky inflation, uncertainty around fiscal policy under the new administration, and the worsening government debt position are all putting pressure on Treasury yields. And that has leaked through to other sovereign debt markets.

Chart 2. Yields have soared in recent months despite rate cuts.

Source: Bloomberg LP, Ascalon.

Rate cut expectations have been materially pared back.

Policy rates remain restrictive, and markets have significantly repriced for fewer rate cuts this year. In Australia, we expect rate cuts to start in the first half of the year. The first rate cut is fully priced for April but may be as early as February. Rates have been restrictive for some time and the consumer has started to feel the bite from higher mortgage rates.

In September, the US Fed median dot plot was for another four rate cuts in 2025, and that was in line with market expectations. The latest Fed dot plots showed that had been revised back to two, and latest market pricing is for just over one. That is a material shift in the outlook compared with just three months ago.

Those dot plots in the December Statement of Economic Projections from the Fed spooked investors in both bond and equity markets. The anticipation of rate cuts acted as a tailwind to equities over 2024. And that repricing has weighed on equity markets and sent bond yields soaring.

Monetary policy works with long and variable lags. And rates are still at a restrictive level. Higher rates could weigh on the economy. That could limit earnings and margins. We have already seen investors punish companies where earnings growth is weaker than expected or the outlook muted.

Prepare for market volatility as elevated valuations meet slowing growth.

US and global equity valuations remain stretched. A significant reacceleration in economic growth would be required to justify those valuations, which is unlikely in our view. Rate cuts in Australia may provide a near-term boost to the Australian equity market, but that may depend on whether the rate cuts are surgical or emergency if the economy slows too much. We expect that markets could continue to be reactive to policy and data.

There will be an onus on corporate earnings growth to increase sufficiently to justify the elevated valuations. After two years of 20% plus returns, and a long run average in high single digits, we think investors should be prepared for a more muted year in equity markets. But we acknowledge that high valuations of themselves do not require a correction. We think a sensible way for investors to navigate this is to embrace diversification and build portfolio resilience, while remaining invested through some volatility.

Disclaimer: This presentation has been prepared by Oreana Private Wealth, a division of Oreana Financial Services(Oreana) for general information purposes only, without taking into account any potential investors’ personal objectives, financial situation or needs. This information consists of forward-looking statements which are subject to known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements to be materially different from those expressed or implied. Past performance is not a reliable indicator of future performance. Neither this document nor any of its contents may be used for any purpose without the prior consent of Oreana. Anyone reading this report must obtain and rely upon their own independent advice and inquiries.

Limitation of liability: Whilst all care has been taken in preparation of this report, to the maximum extent permitted by law, Oreana will not be liable in any way for any loss or damage suffered by you through use or reliance on this information. Oreana’s liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Oreana’s option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you.