Stay invested through volatile markets

Market Insight

25/03/2025

We wrote in January about being prepared for market volatility as elevated global equity market valuations were likely to meet slowing global growth. We have seen volatility increase over recent weeks as economic and geopolitical concerns weighing on investor sentiment and dragging equity prices lower. Despite the elevated uncertainty, long-term investors should remain invested, stay diversified, and consider dollar cost averaging strategies to benefit from any drawdowns.

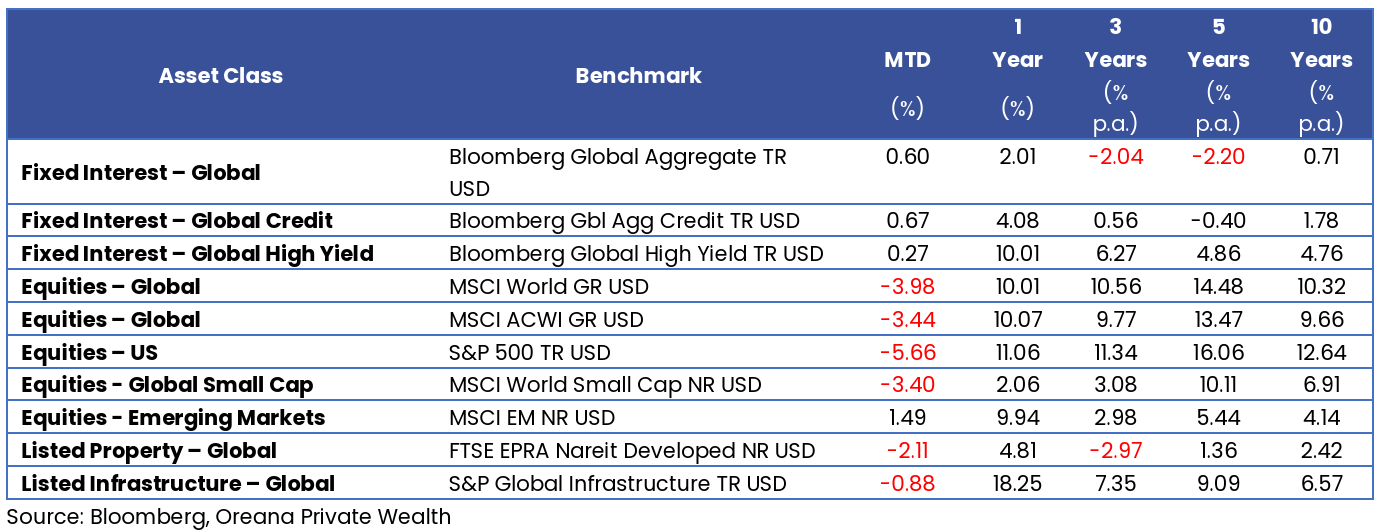

Table 1. Market movements as of 10/3/2025

Uncertainty around policy and the economic outlook is elevated

Markets have been struggling to digest the imposition of US tariffs, US foreign policy uncertainty, signs of slowing growth, and sticky inflation. President Trump has backtracked on several tariff policies – before and after implementation – that has made the business environment very challenging. But most of those tariff U-turns have been delays rather than cancellations, making the outlook extremely murky. Meanwhile, widespread layoffs in federal government departments have spooked consumers. That has added to uncertainty around the economic outlook which is starting to feed through in hard economic data.

The US labour market added less jobs than expected in February – 151k jobs were added which was below economists’ expectation of 160k. The unemployment rate ticked up from 4.0% to 4.1%. The ISM manufacturing purchasing managers’ index dropped to 50.3 in February from 50.9 the previous month, leaving it just above contraction territory, with a sharp fall in new orders from 55.1 to 48.6.

Inflation has continued to trend lower, but the trend has slowed. Some areas have remained sticky. The latest ISM Prices Paid index soared over 62 suggesting price pressures remain. But the latest core PCE inflation – the Fed’s preferred measure of inflation – nudged lower. Tariffs are typically inflationary, as the tariff acts as a tax to businesses, that may be passed on to consumers.

Expectations matter

We encourage investors not to panic

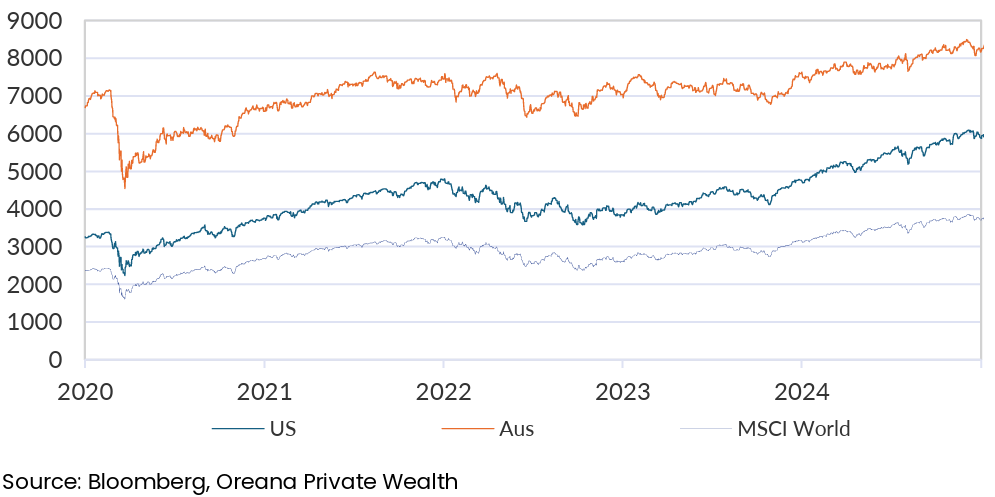

Chart 1. Equity prices have soared over the longer-term despite the latest market slump

Outside the US, markets have performed relatively well. European equities are up 10% year-todate, while Chinese equities have soared on Hong Kong’s Hang Seng Index. Fixed income and investment grade credit are currently offering relatively attractive yields and can provide some cushioning in case of a downturn. We encourage investors to steer away from high yield credit, as we do not think it is worth taking on the additional risk for limited additional yield.

What actions can investors take?

While uncertainty is painful for investors, there are some actions that can help navigate volatility.

• Remain focused on the longer term. History shows that remaining invested and sticking to processes delivers long-term portfolio returns.

• Embrace a diversified portfolio – this has been particularly important as global equity indices became increasingly concentrated in a small number of mega cap companies.

• Embrace dollar cost averaging. Over the long term this can help smooth out volatility and take advantage of near-term drawdowns.

• Build portfolio resilience. Allocating to assets with some downside protection can help within a diversified portfolio.

Review your investment objectives and risk tolerance. Take the opportunity to speak to your adviser and ensure your portfolio is still suitable for your investment goals.

Our team at Oreana are available to work with you through any of these actions as markets stay volatile, to help achieve your investment needs.

In Hong Kong, we are licensed by the Securities and futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563). In Australia, we are licensed by the Australian Securities and Investments Commission (AFS No: 482234, ABN 91 607 515 122).