Staying invested through volatile markets

Market Insight

02/11/2023

Short-term market movements are normal. Admittedly, markets have been particularly volatile this cycle. Crosscurrents from various factors have caused ripples across all asset classes. Correlations have broken down. Sometimes bad news is good news, sometimes good news is bad news. Sometimes bad news is just bad news. We live in a world where we are bombarded with conflicting news and narratives news cycle which makes it tempting to react.

But now is not the time to cut losses and exit markets.

Timing the market is difficult.

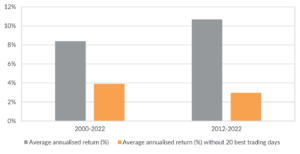

Correctly timing the market is difficult, if not impossible. With hindsight, all peaks and troughs appear forecastable and investable, but the reality is far from that. Even with a tried and tested market timing process, most investors will not be able to avoid the worst days, or take advantage of the good days. And that is costly for long-term investors. Missing just 20 of the best trading days over the last 20 years more than halved the return from the ASX200 between 2000 to 2022.

Chart 1: Investors’ returns are slashed by missing just the 20 best trading days over any given period.

Source: Bloomberg LP, Oreana.

At the same time, most investors will want to cut their losses after markets have tumbled. That means selling assets at their lows and having lost money, and also makes investors likely to miss out on the benefits of a recovery.

Maintain a disciplined investment approach.

Market volatility is a challenging time for investors. It is important not to take knee-jerk reactions in response to market movements. We suggest investors clearly understand their investment objectives, and the processes and philosophies that are used to increase the likelihood of achieving that objective.

When we speak with investors, we focus on:

- Understand your objective: Keep in mind your financial goals, risk tolerance and investment timeframe.

- Rely on and follow your investment philosophy: Know what you believe, and what types of actions follow from your beliefs. Have a copy of your beliefs at hand during volatile periods.

- Clearly understand your investment processes including:

- Portfolio construction: What level of growth and defensive assets do you need to achieve your objectives?

- Asset allocation: Do you use strategic asset allocation, dynamic asset allocation, active or passive investment strategies?

- Implementation: Are the strategies or funds in which you invest appropriate for their role in the portfolio?

- Trust your governance framework: Rely on your investment committee and governance budget to keep you on the path to achieving your objectives.

- Monitor outcomes: Review your performance against objectives and ensure you remain on the path to achieving them.

Periods of volatility do not last forever. But they are challenging moments even for the most professional and experienced investor. Adhering to a clear set of steps can help navigate these periods and keep you on the path to achieving your investment objective.

Diversify your portfolios.

Diversification remains a critical component of achieving investment objectives. Appropriate diversification in your portfolio tends to reduce the overall risk of a portfolio. It can help reduce downside risk, the risk of loss of capital, and the risk of not achieving your goals. Diversification between and within asset classes can also reduce the volatility of your portfolio, making for a less challenging journey towards your goals.

Focus on the medium-term.

Right now, we think focusing on diversification and increasing portfolio resilience will help investors reach their financial goals over the medium-term. Volatility is more noticeable in the near-term, but we encourage investors to focus on the medium-to-long term.

For some investors, active portfolio management (which we call dynamic asset allocation) may be appropriate. We have undertaken scenario analysis to consider a range of outcomes. We can use those scenarios to adjust portfolios. As discussed in last month’s Insights, government bonds look attractive in all plausible scenarios. We have been adding to government bonds as yields are elevated and offer good income. We have also increased our allocation to cash instruments for further protection. We have reduced our absolute exposure to equities and increased our bias to quality.

Chart 2: Government bond yields have surged to levels that offer good income and downside protection.

Source: Bloomberg LP, Oreana.

For other investors, a more long-term strategic approach may be appropriate. But strategic does not mean setting and forgetting. Periods of volatility provide important moments for investors to rebalance their portfolio back to their long-term asset allocation targets. This allows them to sell assets that have increased in value, and rebalance back to assets that have fallen in value. This discipline helps prevent the temptation to sell out of assets at their lows in price.

Risks are to the downside.

Narratives have become conflicted in recent months. Contradictory central bank action, inflation, and economic data have become the norm and left investors and markets with limited clear direction. Tensions between investors and markets have escalated which has resulted in significant volatility. That leaves risks to the downside. We expect the next few months could be very challenging in markets. But that does not mean exiting the market.

To navigate uncertain environments, it is important to:

- Focus on portfolio objectives and timeframe,

- Maintain a disciplined investment approach – whether that is dynamic or strategic,

- Trust the benefits of diversification,

- Prepare and build portfolio resilience, but don’t panic!