The Outlook for Gold

Market Insight

20/02/2025

The price of gold has increased more than 70% since it found a bottom in late 2022. Gold is a difficult asset to value, given that it does not produce cash flows. But gold can be a useful diversifier for portfolios. There are several factors supporting the gold price right now, but it is difficult to escape the fact that prices are already at all-time highs.

The gold price has surged since 2022

Source: Bloomberg LP, Ascalon.

What influences gold prices?

Gold prices are impacted by fundamentals, economic factors, and investor sentiment.

Fundamentals

Mining Production: When gold mining output decreases, it creates a supply constraint that supports higher prices. In 2025, mining production is forecast to peak at historic highs, which could put some downward pressure on prices.

Jewelry Demand: The jewelry industry is a major consumer of gold, and increased demand can drive prices up. In 2024, gold demand is forecast to increase in India but slow in China.

Industrial Use: Gold has applications in technology and medicine, which can affect demand. Recent changes in technology and electronics in increasing industrial demand for gold.

Economic factors

US Dollar Value: Gold typically has an inverse relationship with the US dollar. When the dollar weakens, gold prices tend to rise. More recently, the US dollar has strengthened, but it has not put downwards pressure on gold.

Gold has remained strong even as the USD has strengthened.

Source: Bloomberg LP, Ascalon.

Interest Rates: Lower real interest rates often lead to higher gold prices, as the opportunity cost of holding non-yielding gold decreases. Real interest rates have declined over the past few months, supporting gold prices.

Real yields have declined over the past three months, supporting Gold.

Source: Bloomberg LP, Ascalon

Inflation: Gold is often seen as a hedge against inflation, with prices rising during periods of high inflation. While inflation has slowed over the past year, there are concerns that the US fiscal deficit, tariffs and labour market policies could prove inflationary, supporting the gold price.

Investment Sentiment

Safe Haven Asset: During times of economic or geopolitical uncertainty, wars, political crises or instability, investors often flock to gold as a safe haven, driving up prices. The past 24 months have been a period of uncertainty. That looks unlikely to change in the near-term.

ETF Flows: Demand for gold ETFs can impact prices, as increased investment leads to higher buying volume. The move proliferation of ETFs has allowed retail flows into gold, which has boosted demand.

Central Bank Buying: When central banks increase their gold reserves, it can significantly boost demand and prices. Central banks were significant buyers of gold through 2024, and this could continue through 2025.

Market Volatility: Increased volatility in other markets can drive investors towards gold. It seems plausible that the significant increase in bond market volatility may have driven some investors into gold over the past 3 years.

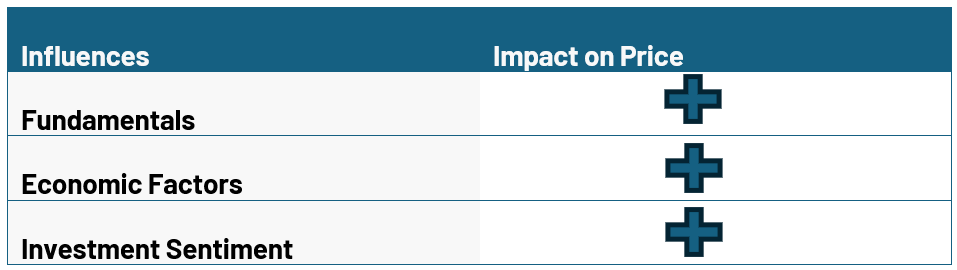

In the table below, we show that we think broadly, the fundamentals, economic factors and investment sentiment are supportive of the gold price.

However, we are reluctant to call a major extension of the gold bull market. This is because the gold price is already at record highs and that historically means downside risks are elevated. We think that at these levels investors should be cautious about adding exposure to gold, and investors that are holding an allocation as a diversifier should consider appropriate price levels to reduce their exposure.

Disclaimer: This presentation has been prepared by Oreana Private Wealth, a division of Oreana Financial Services(Oreana) for general information purposes only, without taking into account any potential investors’ personal objectives, financial situation or needs. This information consists of forward-looking statements which are subject to known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements to be materially different from those expressed or implied. Past performance is not a reliable indicator of future performance. Neither this document nor any of its contents may be used for any purpose without the prior consent of Oreana. Anyone reading this report must obtain and rely upon their own independent advice and inquiries.

Limitation of liability: Whilst all care has been taken in preparation of this report, to the maximum extent permitted by law. Oreana will not be liable in any way for any loss or damage suffered by you through use or reliance on this information. Oreana’s liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Oreana’s option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you.