The year in review

Market Insight

23/12/2024

The global economic and financial landscape in 2024 has been characterized by moderate growth, persistent inflation challenges and varying market performance across regions and asset classes. Central banks across the globe started to cut policy rates in H2 2024, while key election outcomes and instability in the Middle East and war in Ukraine left geopolitics volatile. Global equities, led by the so-called Magnificent 7, surged ahead. The S&P500 is more than 25% higher year-to-date. Fixed income has also performed well, helping diversified portfolios to solid absolute returns year-to-date.

Resilient growth, sticky inflation.

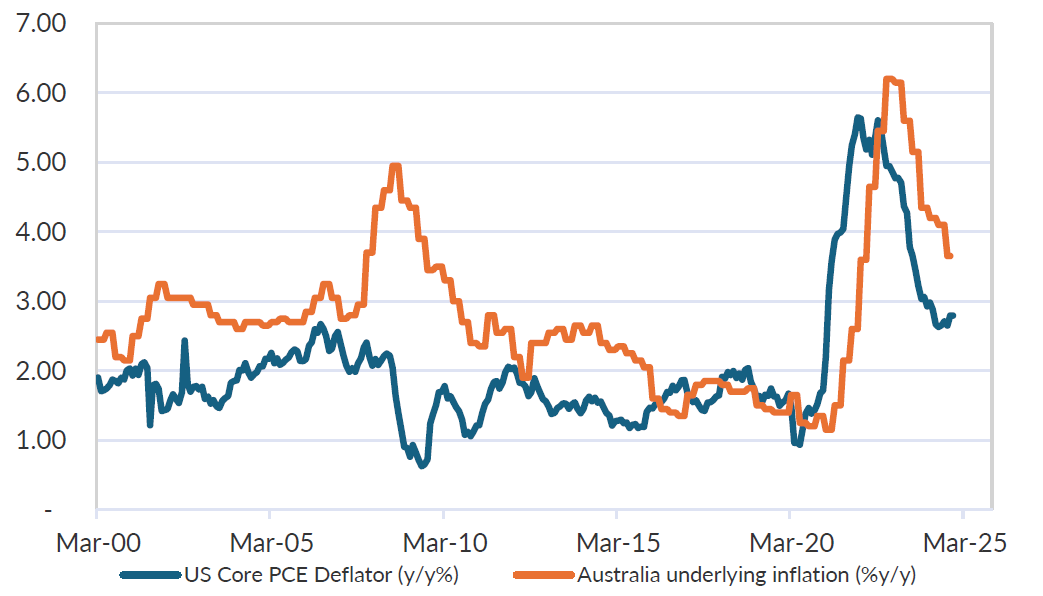

Global growth remained solid during 2024 albeit with differences across key economies. The US trended slower but growth was better than consensus had expected at the end of 2023. US growth was underpinned by resilient consumer spending. Inflation trended lower for the first part of the year but has stalled out at levels that are still too high to be comfortable for the Fed.

Chart 1: US and Australian inflation has proven sticky in H2 2024.

Source: Bloomberg LP, Ascalon.

In Australia, growth was weak and negative in real per-capita terms. Confidence was low and the main driver of growth was government spending which has ballooned at a Federal and State level. Inflation remained sticky above the RBA’s target levels, proving a drag on the housing and household sectors.

In China, growth started to stabilize after significant fiscal and monetary support from China’s authorities. But domestic demand has been weak and outright deflation remains a threat to China’s economic outlook.

Rates have peaked and are trending lower.

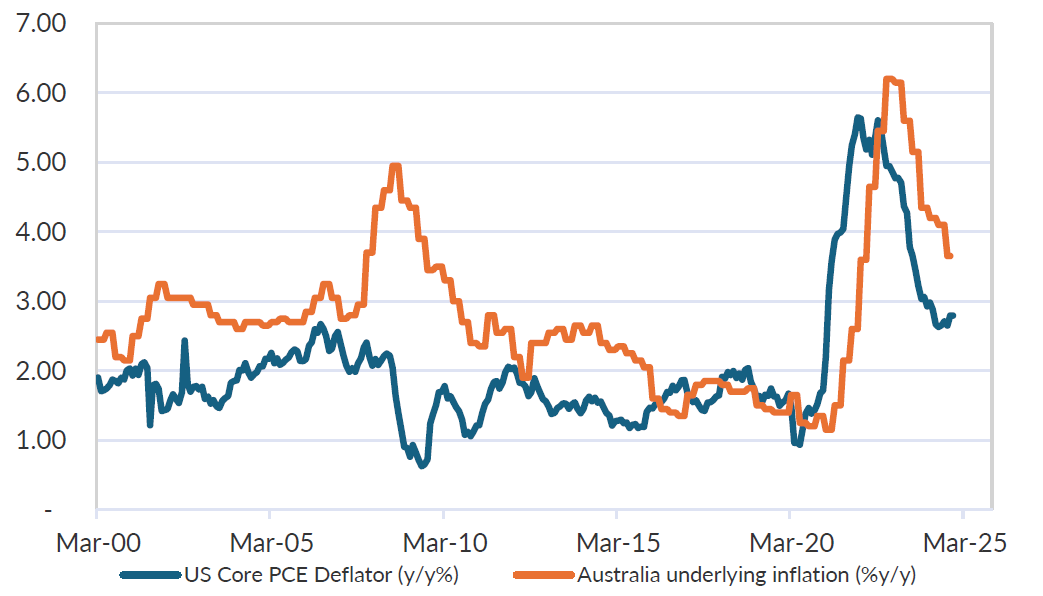

The Fed began cutting rates in September, delivering a 0.50% rate cut, and following with another in November. Markets expect further rate cuts in 2025 but sticky inflation has reduced the number of rate cuts priced in.

The BoJ hiked rates through the year, ending years of negative interest rate policy. Rate hikes, coupled with strengthening yen and weak US jobs data triggered a volatile period in early August, where the Nikkei fell 12.4% in a day, dragging global equities lower. But markets soon recovered as investors focused on policy support and earnings expectations from AI companies.

In Australia, the RBA pushed back against the prospect for rate cuts, leaving markets pricing the first rate cut in H1 2025. More recently, the RBA has turned dovish, indicating a rate cut could be delivered earlier in 2025. But the strong Australian labour market, coupled with sticky inflation, has challenged that view.

Chart 2: The Fed, BoE and ECB cut rates in 2024.

Source: Bloomberg LP, Ascalon.

Geopolitics largely took a back seat.

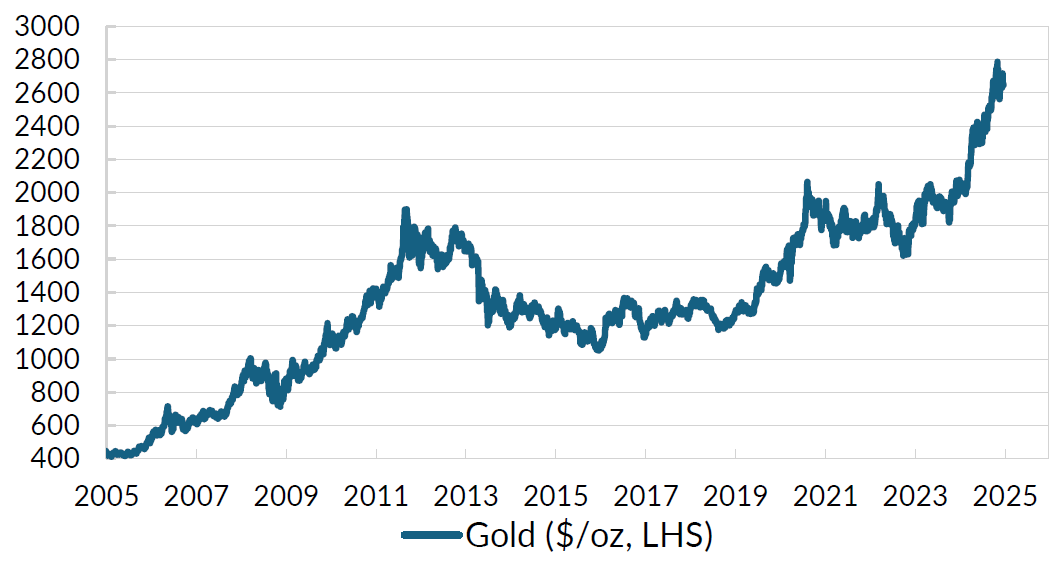

The instability in the Middle East and ongoing war in Ukraine have been largely overlooked by investors. Markets have seemingly become insensitive to geopolitical risks, which remain significant. Oil prices have declined year-to-date. On the other hand, gold has surged and is more than 25% higher. The surge in gold reflects some concerns about global risk, but is probably more a hedge against inflationary pressures that remain sticky.

Chart 3: Gold has rallied sharply through 2024.

Source: Bloomberg LP, Ascalon.

The US election stood out as a major geopolitical flashpoint through 2024. President-elect Trump swept the polls and has a policy outlook that includes tariffs, immigration policy but also pro-growth fiscal policy. Markets latched onto the latter in the wake of the election, sending US equities to fresh highs. But more recently, markets are raising questions around the risk from inflation as a result of tariffs.

Markets have maintained positive momentum.

The market’s positive momentum from 2023 carried into 2024 with the Magnificent 7 leading the S&P 500 to 38 fresh all-time highs during the first half of the year. AI mania continued with NVDA surging ahead and dragging the market with it.

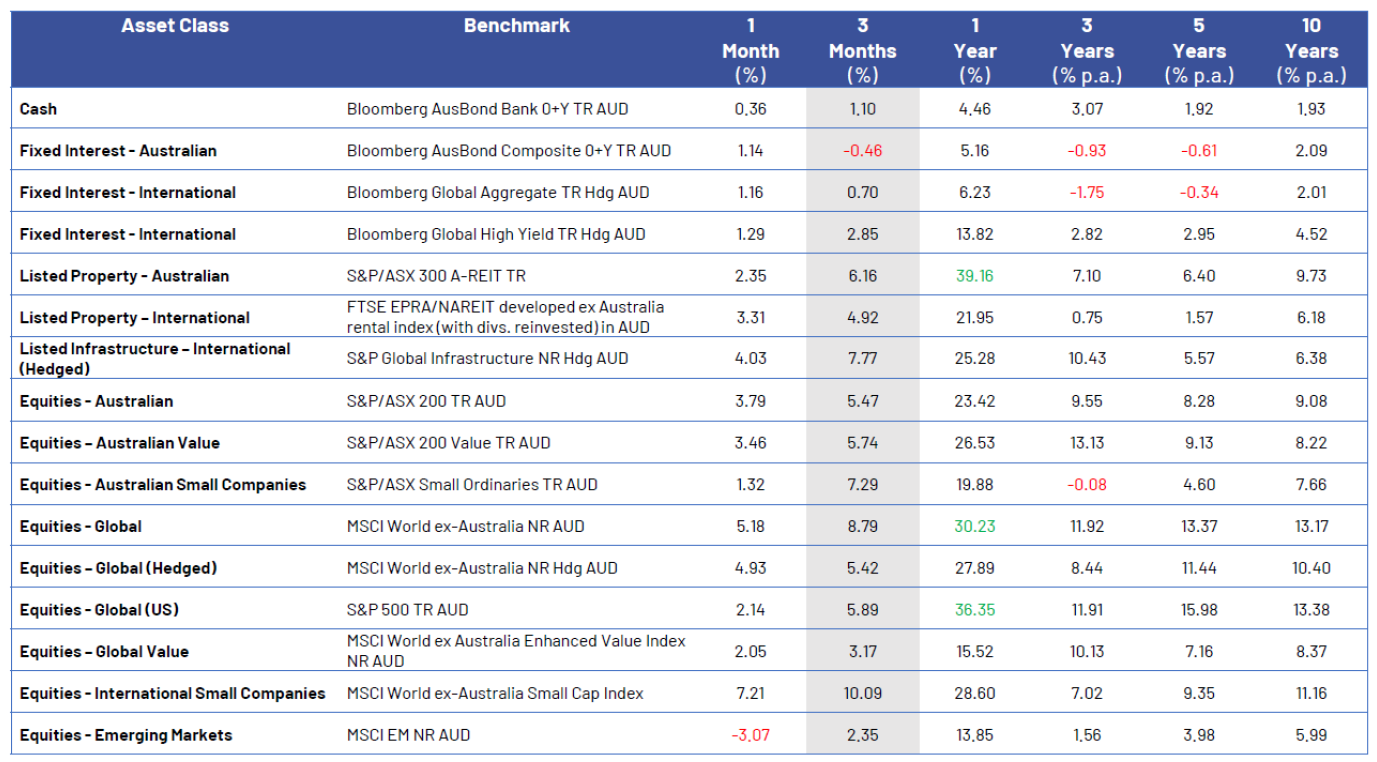

Dips in the equity market were shallow and short lived. Valuations stretched to ever increasing highs, even as earnings growth remained modest at best. The S&P500 looks set to achieve a second year of 20%+ gains, leading global equities to solid outcomes even where earnings were much worse.

The Australian equity market was dragged higher, but fundamentals were materially worse. Earnings growth has been very weak, economic growth has been slow, and much of the investment and spending driving that growth was government led.

Fixed income has benefited from higher yields, supporting income, and credit spreads narrowing in both investment grade and high yield credit. US Treasury yields and Australian government bond yields have increased from the lows at the start of 2024. But credit spreads are near multi-decade tights and the combination has been positive for investors in fixed income.

Table 1: Most asset classes have had strong returns through 2024.

As of November 2024

A lot of good news is priced in.

Markets have moved to price a positive outlook. The consensus for a soft landing, or no landing, or reacceleration in growth has consolidated after the US elections. With markets largely priced for perfection, there will be an onus on corporate earnings growth to increase sufficiently to justify the elevated valuations. After two years of 20% plus returns, we think there is some downside risk to the positive consensus, but acknowledge that high valuations of themselves do not require a correction. We think a sensible way for investors to navigate this is to embrace diversification and build portfolio resilience, while remaining invested even if volatility does pick up from current low levels.