What is going on with gold?

Market Insight

23/10/2025

The gold price has increased more than 50% year to date, and more than 150% from the trough in 2022. After trading sideways from April to August, the gold price moved sharply higher through September. There are plenty of explanations ex-poste for the surge. These include rising government spending and debt, rising inflation, geopolitical uncertainty, and reduced confidence in the US dollar as the global reserve currency. While all these explanations have some merit, the challenge for investors is that gold has no income stream and so it is difficult to build a valuation model for the precious metal. In this note, we review the rise in gold and offer a cautious take on adding to gold exposure at these prices.

Chart 1: Gold prices have surged since August 2025

Source: Bloomberg LP, Ascalon.

A multi-lens approach to valuing gold.

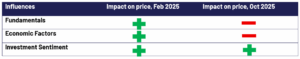

Gold prices are impacted by fundamentals, economic factors, and investor sentiment. Earlier this year in February, we highlighted that all three looked to be positive for the gold price. Right now, gold looks like it is being driven increasingly by sentiment and momentum, rather than economic factors.

Fundamentals

Mining Production: When gold mining output increases, more supply can drive lower prices. In 2025 and 2026, mining production is forecast to peak at historic highs, which could put some downward pressure on prices.

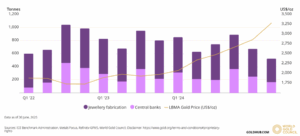

Jewellery Demand: The jewellery industry is a major consumer of gold. At the current prices, jewellery demand is being constrained in China and India, the largest sources of demand.

Central bank Demand: Central banks were significant buyers of gold in 2022-2024. Data suggest that demand has started to slow in 2025 – and we would expect current prices will leave central banks wary of adding significantly to gold reserves.

Chart 2: Jewellery demand and central bank demand for gold has decreased recently.

Source: World Gold Council.

Industrial Use: Gold has applications in technology and medicine, which can affect demand. Recent changes in technology and electronics in increasing industrial demand for gold.

Economic factors

US Dollar Value: Gold typically has an inverse relationship with the US dollar. The weaker USD in H1 2025 supported gold price. But the dollar has traded sideways in H2 – at odds with the rapid increase in gold prices.

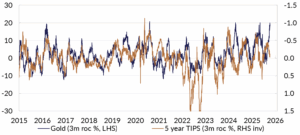

Interest Rates: Lower real interest rates often lead to higher gold prices, as the opportunity cost of holding non-yielding gold decreases. Chart 2 shows that the recent rapid increase in gold is out of line with the stalling real yields – suggesting downwards pressure on the gold price.

Chart 3: The increase in the gold price is at odds with the change in real Treasury yields.

Source: Bloomberg LP, Ascalon.

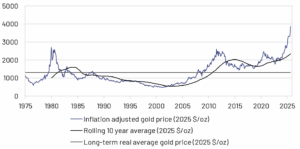

Inflation: Gold is often seen as a hedge against inflation, with prices rising during periods of high inflation. One way to test this is through the “golden constant” which captures the idea that gold should have a long-term real price that is broadly constant. Chart 3 shows that the current real gold price is materially higher than both a long-term real average price and a rolling 10-year average real price. That suggests that the real price may have stretched well beyond fundamentally driven inflation concerns.

Chart 4: The real (inflation adjusted) gold price is much higher than suggested by long-run inflation.

Source: Bloomberg LP, Ascalon.

Investment Sentiment

Safe Haven Asset: During times of economic or geopolitical uncertainty, wars, political crises or instability, investors often flock to gold as a safe haven, driving up prices. The past 24 months have been a period of uncertainty. That looks unlikely to change in the near-term.

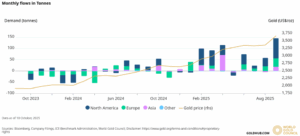

ETF Flows: The proliferation of ETFs has allowed retail flows into gold, which has boosted demand. Data from the World Gold Council show a surge in September as prices increased. This momentum-based buying could persist for some time as buyers chase returns.

Chart 5: Flows into gold ETFs surged in September as the price soared.

Source: World Gold Council

Market Volatility: Increased volatility in other markets can drive investors towards gold. It seems plausible that the significant increase in bond market volatility may continue to drive some investors into gold.

In the table below, we show that we think broadly, the fundamentals and economic factors are less supportive of the gold price than in early 2025. Investment sentiment is the key driver of further increases – and we think that leaves gold susceptible to a price correction.

Table 1: Conditions are less supportive of the gold price than they were in early 2025.

A time for caution.

The surge in the gold price has attracted growing calls for ever higher prices. Explanations are being fit to the increases to justify the rapid melt up in the gold price. Back in January, conditions looked ripe for a move higher. But we think this is less clear now.

It is important to remember that while gold can play a useful role in portfolios as a diversifier, it is an asset that has historically fallen more than 50% from peak prices and remained below historic peaks for very extended periods. While the cost of extracting gold sits around USD1500/oz, we think risks to the current gold price are increasingly subject to an asymmetric skew to the downside. We suggest caution in adding to portfolios at this time, and recommend reviewing existing holdings as a sensible action.

Disclaimer: This presentation has been prepared by Oreana Private Wealth, a division of Oreana Financial Services(Oreana) for general information purposes only, without taking into account any potential investors’ personal objectives, financial situation or needs. This information consists of forward-looking statements which are subject to known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements to be materially different from those expressed or implied. Past performance is not a reliable indicator of future performance. Neither this document nor any of its contents may be used for any purpose without the prior consent of Oreana. Anyone reading this report must obtain and rely upon their own independent advice and inquiries.

Limitation of liability: Whilst all care has been taken in preparation of this report, to the maximum extent permitted by law, Oreana will not be liable in any way for any loss or damage suffered by you through use or reliance on this information. Oreana’s liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Oreana’s option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you.